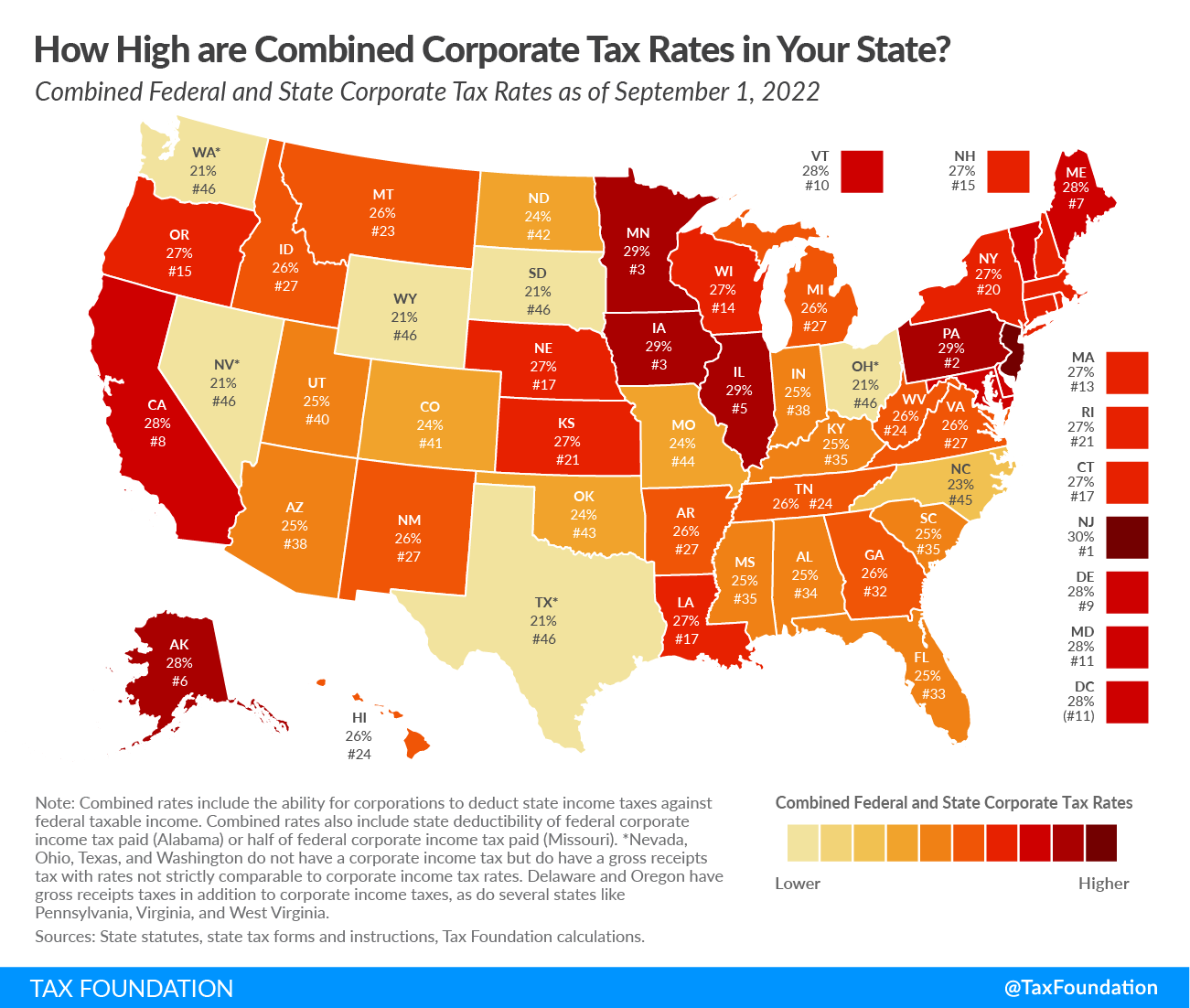

Another Study Confirms: U.S. Has One of the Highest Effective Corporate Tax Rates in the World | Tax Foundation

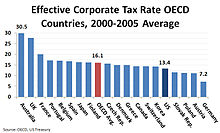

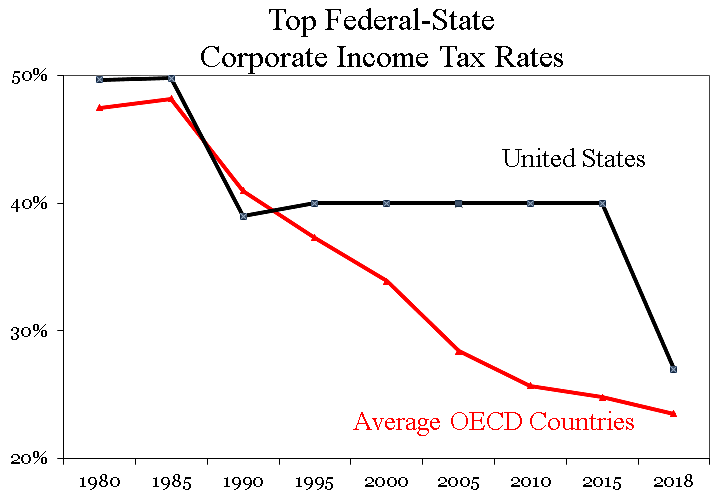

Tax Reform: The Key to a Growing Economy and Higher Living Standards for All Americans" (Testimony Before the U.S. House of Representatives Committee on the Budget) | Tax Foundation

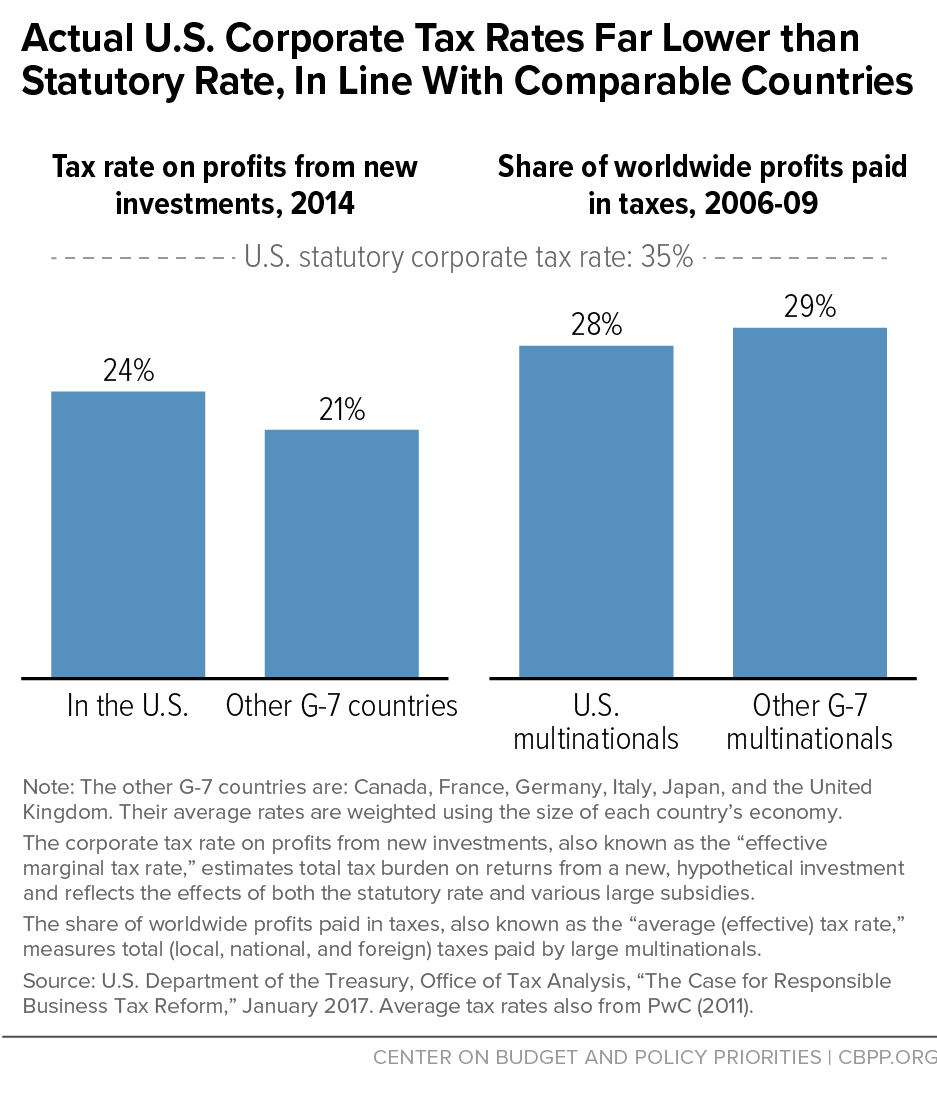

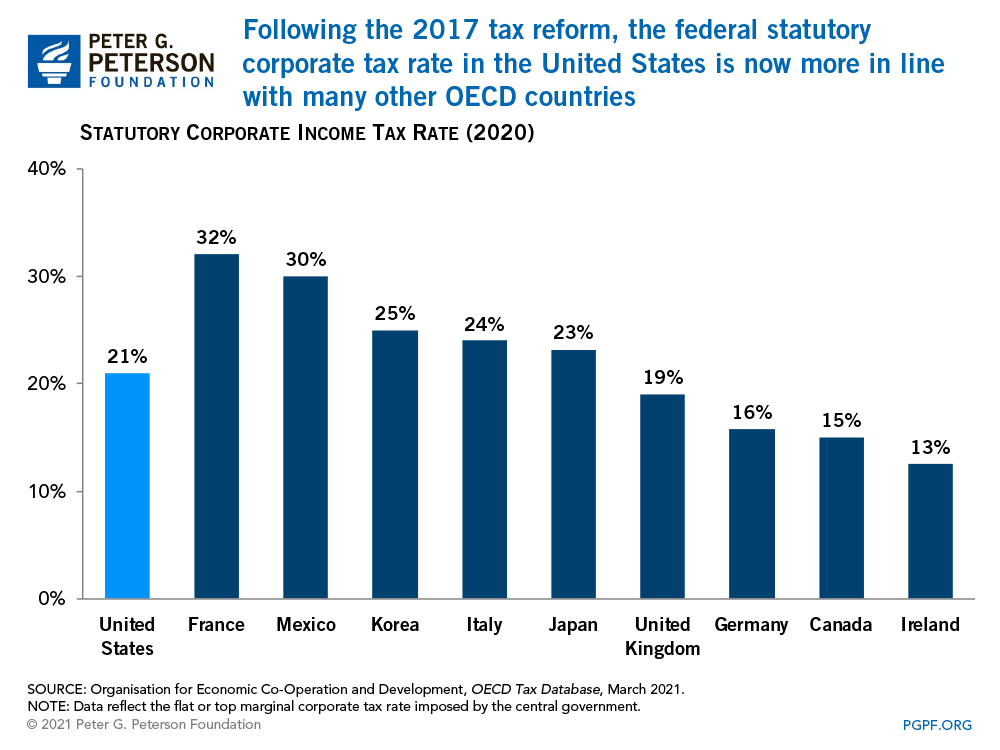

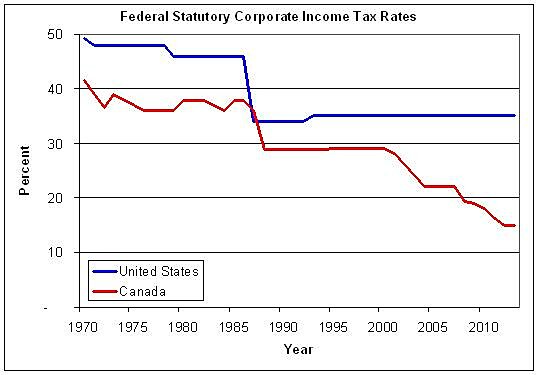

Actual U.S. Corporate Tax Rates Are in Line with Comparable Countries | Center on Budget and Policy Priorities

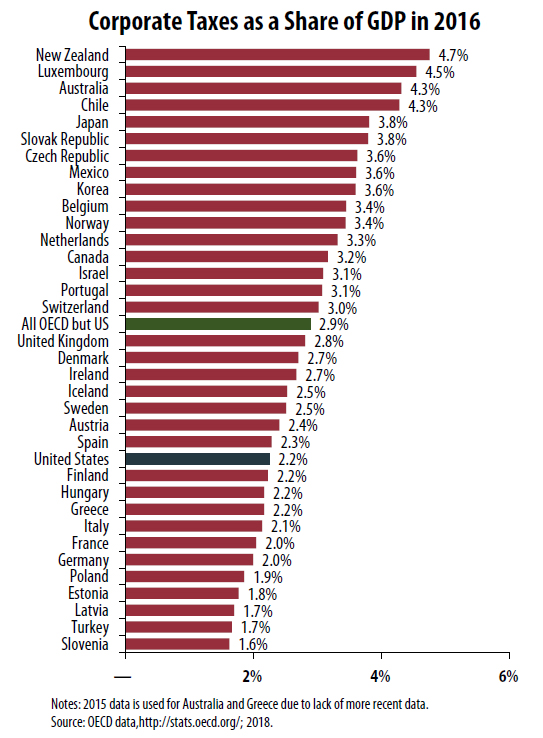

How do US corporate income tax rates and revenues compare with other countries'? | Tax Policy Center

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4E3SRXWUZNNLZJU52JK6NRD53I.png)